Journal Entry Process

Table of contents

Introduction

The journal entry process is critical because journal entries are the workhorse of accounting for finance teams. Unfortunately, many accounting departments still use manual processes for journal entries, effectively putting sand in the gears of their accounting machinery. Automation of accounting journal entries can streamline the process and unlock many benefits.

The Importance of Journal Entries in an Organization

Journal entries are the basic building blocks of any organization’s accounting system. They are used to record and track every financial transaction for the business and serve as the first step in the accounting cycle. Accordingly, the essential purpose of journal entries is to keep the company’s financial information organized.

Beyond the initial recording of transactions, general journal entries also serve as the basis for the company’s financial statements. Balance sheets, income statements, cash flow statements – none of these essential documents could be prepared without journal entries. Since these documents are utilized for performance measurement, the journal entry process is vital for maintaining and maximizing a company’s financial health.

Journal entries are also the foundation for the auditing process. Whether internal or external, auditors will look to journal entries – and the financial statements they are based on – to perform their functions.

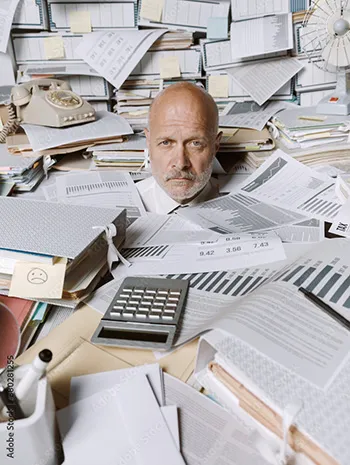

Problems with Manual Journal Entry Processes

In today’s fast-paced economy, journal entries can be overwhelming due to the sheer number of transactions most companies engage in. In addition, there are generally multiple categories of entries and numerous rules for how to process them.

Using manual processes for journal entries makes them even more demanding. The journal entry information is keyed in by hand in a typical manual operation, often into a spreadsheet. Phone, fax, and email are used for communication, and hard copy files are often used to review. The following are some of the main problems with this outdated approach:

More Entry Errors

There is constant potential for human error when journal entry information is entered manually. Spreadsheets do not validate the report, so many errors will go undetected before manually adjusting entry in your accounting software.

Time Wasted

In a large company with multiple departments and a high volume of transactions, entering all will be very time-consuming. And since many finance teams dive into this process at month’s end to reconcile all entries and accounts, the time burden is even more significant.

Approval Delays

Many transactions will require approvals, such as cancellations or reverse entries. With manual processes, these approvals will require multiple emails, multiple reviews, and drawn-out back-and-forth exchanges. If any supporting documentation needs to be reviewed, it may be challenging to locate in varying formats, further slowing the process.

Workflow Bottlenecks

All of the issues listed above will inevitably lead to workflow bottlenecks. The bottlenecks lead to rushed entries and approvals, further compounding the risk of inaccuracy.

Lack of Visibility

Due to the slowness of manual journal entries and reliance on month-end processing, there is a lack of real-time visibility into the company’s transactions and performance.

Risk of Fraud

The lack of visibility and long processing times of manual journal entries give rise to a higher potential for fraud. Manipulating liabilities, expenses, and revenues are manageable in a manual system.

We can quickly see how these dangers manifest by examining the steps in a complex journal process.

Steps in a Complex Entry Process

The following are some typical steps for making journal entries for a large company with a high volume of transactions.

1. Sort Transactions

Before creating your company’s journal entries, you will first need to sort the transactions by type, such as expenses, bank deposits, etc. This is required to determine whether the transactions affect assets, expenses, revenue, or another financial category.

2. Prepare Journal Entries

Each journal entry is created with a unique reference number and a date. The affected accounts must be identified, and the correct amounts entered as debits and credits to those accounts. Finally, a brief description of the transaction must be included.

In accordance with the standards of double-entry accounting, the debits and credits must zero each other out. Consider a simple journal entry example, such as a journal entry for invoice processing. When the accounts payable department receives payment on an invoice, the journal entry will reflect the invoice amount debited to the cash account and an equivalent amount credited to accounts receivable.

3. Obtain Approvals

Certain transactions may require approval by other personnel within the company before the journal entry can be posted in the company’s general ledger. With a manual entry process, this approval is generally obtained via email.

4. Post Reversals for Accruals

The finance team may post reverse journal entries for accrued revenues and expenses at the start of a new accounting period.

How the Steps Could Be Automated

The tasks listed above can be streamlined and combined with automated journal entries. Here are some of the potential features of an automated system.

Automated Journal Entry Templates

Journal entries can be made onto automated templates that contain all the necessary fields, such as date, account names, debit amount, and credit amount. Other fields can also be included to suit the company’s purposes, such as transaction codes and supplier codes. Fields can also have dropdown menus, such as a dropdown chart of accounts under the fields for the accounts debited and credited. Supporting documentation can be attached directly to the journal entry form and reviewed on the automated platform.

Approval Automation

A journal entry can be automatically routed to the correct destination for approval, even for a multi-step approval process with automated journal entry approval. The automated system can also notify approvers when their approvals are overdue.

Controls and Validation

An automated system will automatically follow all internal controls for your finance team. Accordingly, the entry can be sent to the appropriate reviewers based on your business’s rules regarding types of transactions, amounts, and other criteria. Furthermore, all data is automatically validated before posting the entry.

Automated Record-to-Report (R2R) System

Automation also compresses the record-to-report (R2R) cycle. Beginning with recording the transactions and ending with the creation of financial reports, the R2R system can seamlessly move through each stage of the process without the need for manual re-entry of data.

Benefits of Automating

Automation will result in higher speed and accuracy for the initial journal entries. Reviews and approvals will also be faster due to automated routing and easy access to any supporting documentation.

Audits will also be more accurate and less burdensome. The automated system can provide precise traceability data for auditors, such as user, time, date, forms used, and documents attached.

Real-time visibility into the company’s financial picture is also enhanced with automation. Since journal entries are done more quickly, there will be less need to rely on month-end reconciliations. Instead, accounting can be accurately performed on a continuous basis. Fraudulent transactions can be reduced drastically if not eliminated.

Interested in Automating Your Finance Processes?

We have various resources to help you on your journey to an automated workflow.

- Workflow Tools and eBooks

- Workflow Ideas Weekly eMail Newsletter(opens in a new tab)

- Recorded Demonstration of our Workflow Automation Software

- Request a Live Demonstration

Contact Nutrient Workflow for a free demo of how automation can transform your entry process into a streamlined, automated system.