Boost finance approval speed with automation

Table of contents

Automated workflows accomplish speeding up decision-making by initiating requests, automating routing decisions, showing real-time visibility, and being able to customize your workflows to your own approval decisions.

Automation is dramatically improving finance approval cycles by speeding up decision-making.

Digital automation is transforming many facets of modern-day business, and finance operations are no exception to this trend. One key function of finance automation is increasing the efficiency of request-and-approval processes. In fact, automation is dramatically improving finance approval cycles by speeding up decision-making.

To understand how automated workflows accomplish this, we can look at different stages and aspects of typical finance approval cycles. Beginning with the initiation of requests, automation works to increase speed and agility in the approval process. And when those automated workflows are customizable, finance departments can reap some truly impressive rewards.

Initiating Requests with Automation

The first point in the finance approval cycle that presents obstacles comes, unfortunately, early — when the request is initiated. These obstacles are even greater for finance teams using manual workflows and paper-based processes. The requester who submits a paper form can skip a step, fail to supply all the necessary information, or neglect to attach needed documentation. These common oversights effectively stop the approval cycle in its tracks.

Request initiation within automated workflows can reduce or eliminate these problems. Automated forms can require the submitter to complete all the required fields and include all necessary information, even making calculations when essential. This will lower the rate of requests rejected at the outset.

Another advantage of automated systems is a reduction in the number of duplicate requests, as well as inconsistent or conflicting requests. When using traditional processes such as email, fax, or paper-based forms, duplicate and inconsistent requests are a constant hazard. By utilizing a central portal for request submission, automated systems can virtually eliminate this risk.

Automated Routing of Requests

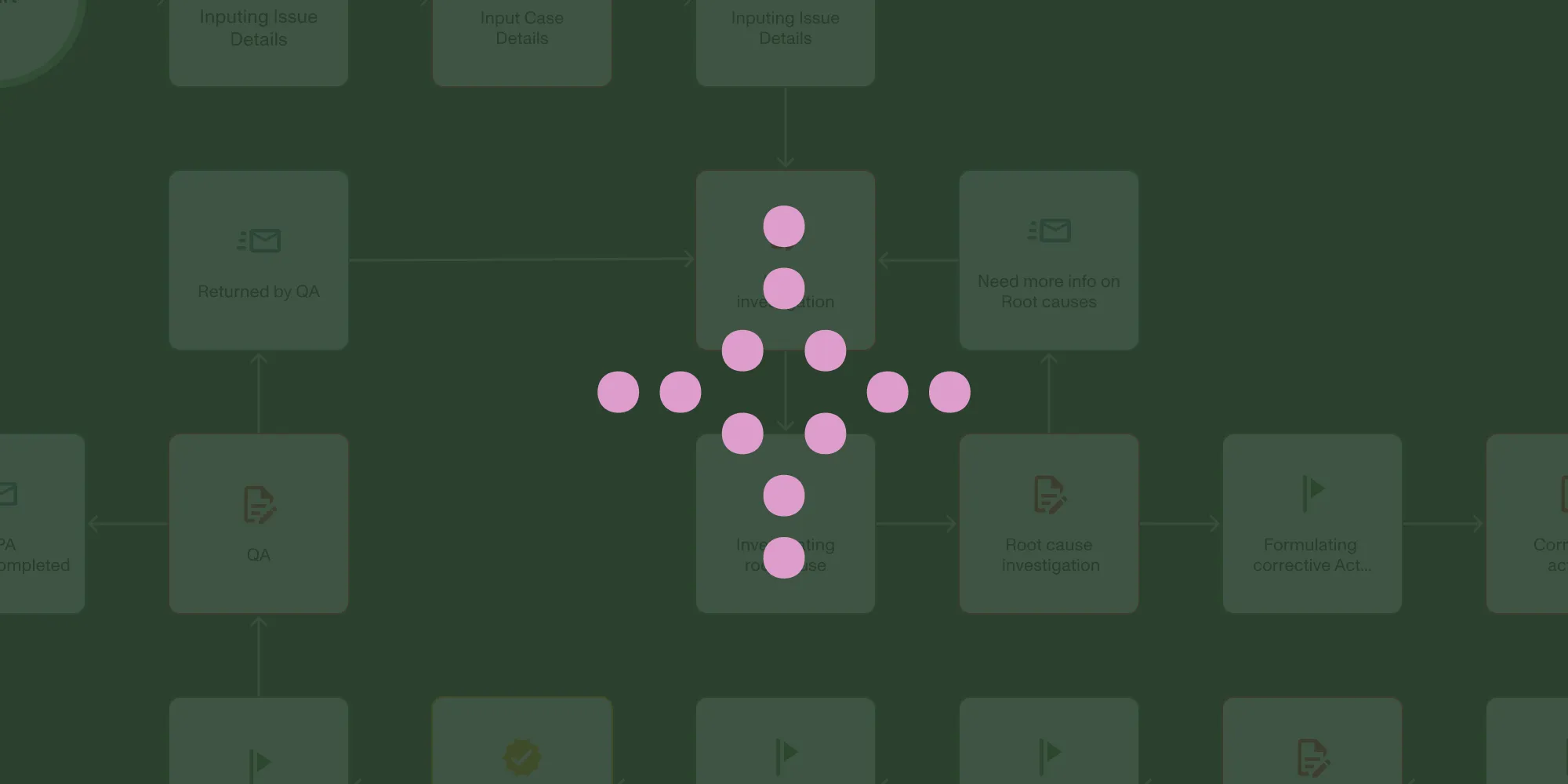

Even when the request is properly initiated, the challenges do not end there. The request must first be submitted to the correct person, or group of persons, for a decision of approval or rejection.

This is complicated by the fact that finance departments usually have numerous internal controls in place for the routing of requests. An invoice approval may require alternate approvers or a series of approvers. A capital expenditure request above a certain dollar amount may need to be elevated to a higher level for approval. Not to mention the fact that many finance requests go through multiple departments within the company. The number of contingencies required for routing even the simplest of requests can be daunting.

Then add to this mix all the problems inherent with finance processes based on spreadsheets, paper forms, and traditional communications such as fax and email. A request can easily be misplaced or misdirected. Steps in the approval chain can be inadvertently skipped. Combine this with the volume of finance requests for even a small enterprise, and you have the recipe for mistakes, lost requests, and bottlenecks everywhere.

An automated platform can overcome these issues by automatically routing requests to the appropriate approvers. Any person in the approval pipeline will have no need to figure out where the request must be directed, either through their own recall or asking around. Instead, the automated system can do so on its own.

Alternate approvers, serial approvers, requests that must be elevated — all of these internal controls can be enforced with less risk of human error. In addition, an approver can request additional information or clarification through the centralized portal, with the response coming back on that same portal.

When an automated system frees up users from decisions about where and how to route the request, this frees them up for more important decision-making — such as what types of requests to make and whether to approve those requests.

Real-time Visibility into Approval Cycles

A major hurdle for traditional finance approval cycles using manual processes is the lack of transparency. Whether a paper memo is sitting on someone’s desk or has been lost entirely, there are often limited ways to find out the status of any given request. If a user has multiple requests pending, this lack of visibility can be even more frustrating and slow down decision-making.

Automated systems can provide real-time visibility by allowing users to immediately view their open requests and request history. Moreover, an automated portal can give users a dashboard that shows big-picture considerations — such as budget impact and the timing of budget items — pertinent to the request-and-approval decisions.

Not only does this visibility lead to quicker and better decisions, but it also increases employee satisfaction. This is critical because it increases the chances that users will be motivated to fully utilize the automated platform. By increasing staff buy-in to the new system, automation can start a virtuous cycle of quicker decision-making and broader implementation.

Customizable Workflows Provide Even Greater Advantages

If your finance team decides to implement automation, one of the first choices will be between pre-built workflows and customizable workflows. While pre-built workflows can seem simpler on a surface level, customizable workflows have some distinct advantages.

When your finance department can customize its workflow processes, it allows for enforcing any business rules and internal controls you wish. Not only can you set up the approval cycles you want, but you may also set up forms and dashboards to fit your needs. If a workflow process needs to be modified for another area — your journal entry workflow versus the accounts payable workflow, for example — then the workflow can be easily copied and modified.

Not only do customizable workflows help your finance approval process, but they also boost the all-important component of employee buy-in to the new system. This is even more true when all the stakeholders are involved in the workflow design and are allowed to provide feedback. Executives, administrators, and end-users — all will be more motivated to make the automated workflows “work.”

Consider Automation for Faster Finance Approval Decisions

For finance teams that want to speed up their finance approval cycles, automation may be the ultimate definition of “working smarter, not harder.” Consider whether automated workflows, whether pre-built or customized, are the natural next step for your company’s finance operations.