Easier and Less Risk CapEx Approval

Table of contents

CapEx Approvals are critical to the operation and growth of your organization. For that reason, it’s just as crucial to have software that simplifies and streamlines the CapEx approval process.

Nutrient Workflow is the only workflow and CapEx approval software that allows users to quickly define, build, and publish customized capital expenditure request processes. With Nutrient Workflow CapEx approval workflows serving as your CapEx management software, you’ll have a new, customized CapEx approval process up and running within weeks, not months.

Benefits of Automating CapEx Approval Workflows

- Reduce request, review, and approval time

- Streamline and standardize processes across multiple cost centers/geographies

- Eliminate error-prone manual or spreadsheet systems

- Compare planned spend vs. actual spend

- Provide a clear and complete audit trail of all activities

- Analyze and report on process performance

- Identify approval process bottlenecks

- Share CapEx data with existing Finance, ERP, and other enterprise systems

- Collaborate with key personnel during the approval process

- Enable regulatory and organizational compliance

Evaluating CapEx Proposals

Evaluating CapEx proposals is a pivotal step in the capital expenditure approval process. A thorough financial analysis is essential to ensure that the proposed investment aligns with the organization’s strategic goals and objectives. Conducting a cost-benefit analysis is a crucial part of this evaluation process.

Conducting a Cost-Benefit Analysis

A cost-benefit analysis involves identifying and quantifying the potential costs and benefits associated with the proposed investment. This includes estimating the expected return on investment (ROI), payback period, and net present value (NPV) of the project. The analysis should also consider the potential risks and uncertainties associated with the investment.

To conduct a cost-benefit analysis, follow these steps:

- Identify Costs and Benefits: Start by listing all potential costs and benefits of the proposed investment. This includes direct costs like equipment and indirect costs such as maintenance.

- Estimate Financial Metrics: Calculate the expected ROI, payback period, and NPV. These metrics will help in understanding the financial viability of the project.

- Assess Risks and Uncertainties: Consider potential risks and uncertainties that could impact the investment. This might include market volatility, regulatory changes, or technological advancements.

- Evaluate Impact on Cash Flow: Analyze how the investment will affect the organization’s cash flow and overall financial performance.

- Compare Costs and Benefits: Weigh the potential benefits against the costs and risks to determine if the investment is worthwhile.

By conducting a thorough cost-benefit analysis, organizations can make more informed decisions about their capital expenditures, ensuring that investments are aligned with strategic goals and contribute positively to cash flow and financial health.

How Nutrient Workflow Manages CapEx/AFE Approvals

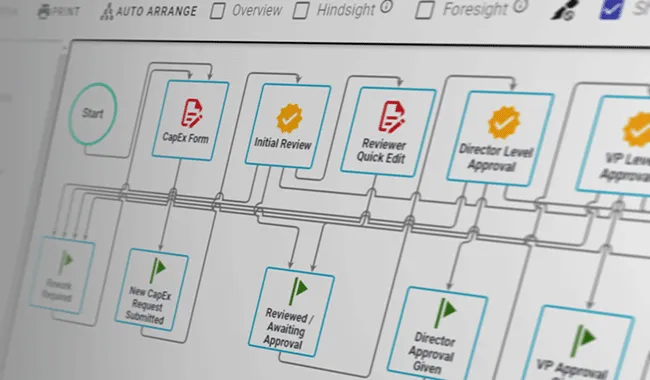

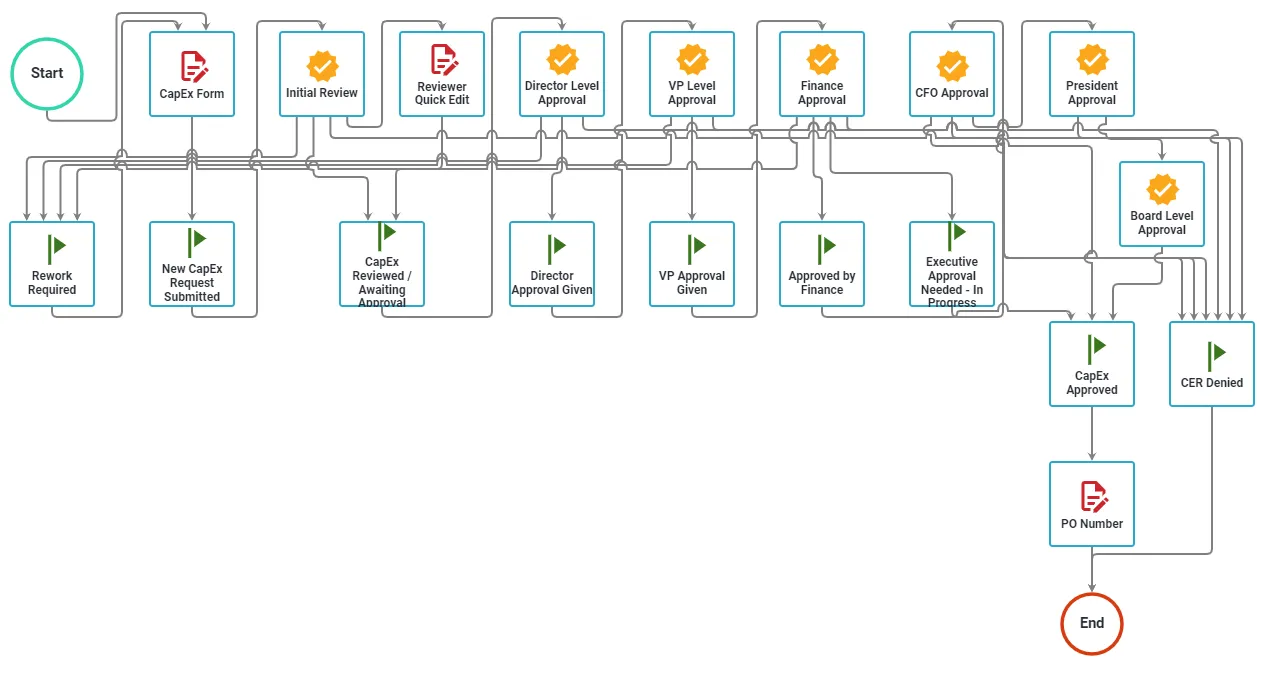

Below is an example of a reasonably simple CapEx Approval Process. Note the multistep approval process from facility to CFO to CEO. Your process could involve even more steps/logic than this.

Example of a CapEx approval workflow. Click for larger.

Example of a CapEx approval workflow. Click for larger.

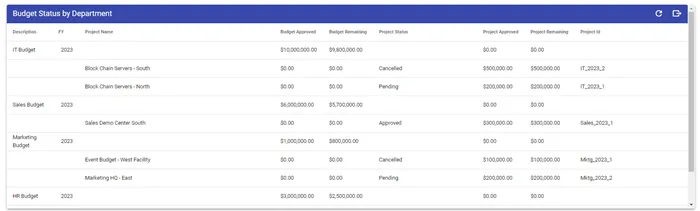

Below is an example of a capital forecasting report built-in Nutrient Workflow and tied to the previous process. Reports can include calculations and refer to tables or existing enterprise finance software.

Example of a CapEx forecasting report in Nutrient Workflow.

Example of a CapEx forecasting report in Nutrient Workflow.

Nutrient Workflow has worked with some of the largest companies in the world to develop sophisticated CapEx and AFE processes that have transformed manual, outdated processes into streamlined, audit-friendly workflows. Our software allows organizations (or our experienced service team) to build custom, automated processes that support your unique way of working rather than trying to shoehorn you into a prebuilt solution.

We have a template for that! Get a headstart on automating your CapEx Process with our CapEx process template. Just import the template, customize it, and launch your new process.

Check Out the Template(opens in a new tab)

Capital Project Management

CapEx projects require close management of key performance indicators that impact cash flow and capital budgets. The long-term impact of mistakes made during capital planning for real estate projects, equipment purchases, leases, patents, etc., is significant.

Using a workflow automation system as part of your capital project management ensures compliance, risk management, and consistent communication. A standardized workflow for capital approvals ensures:

- Capital is deployed appropriately

- Risks are managed, and alternatives are identified

- Expected returns are clear

- The strategy is aligned with executive/board expectations

- Communication and reporting are consistent and accurate

- Governance and quality control are in place

CapEx Approval Workflow Features

- Live calculations displayed in CapEx entry forms

- Dynamic line-item tables for data entry

- KPI tracking for all CapEx process steps

- Organizational hierarchy-driven approvals

- Sequential or parallel approvals

- Manager approval by email or mobile device

- Escalations based on inactivity

- Escalations based on due dates

- Add file attachments

- Complete audit trail

- Manager-driven re-routing

- Designated alternate approvers

- Route by amount, department or any CapEx data

- Ad-Hoc approvals

- Accounting system integration

Best Practices for CapEx Management

Effective CapEx management is critical for organizations to ensure that their capital expenditures are aligned with their strategic goals and objectives. Developing a comprehensive CapEx policy is an essential part of this process.

Developing a Comprehensive CapEx Policy

A comprehensive CapEx policy should outline the organization’s approach to capital expenditures, including the approval process, funding requirements, and project evaluation criteria. The policy should also establish clear guidelines for the submission and evaluation of CapEx requests.

To develop a comprehensive CapEx policy, consider the following steps:

- Define the Approach: Clearly articulate the organization’s approach to capital expenditures, including the strategic importance and expected outcomes.

- Set Submission Guidelines: Establish clear guidelines for how CapEx requests should be submitted, including required documentation and timelines.

- Outline the Approval Process: Detail the steps involved in the CapEx approval process, from initial submission to final approval. This should include the roles and responsibilities of all stakeholders.

- Specify Funding Requirements: Define the funding requirements for CapEx projects, including budget limits and funding sources.

- Establish Evaluation Criteria: Set criteria for evaluating CapEx requests, such as financial metrics, strategic alignment, and risk assessment.

- Communicate the Policy: Ensure that the CapEx policy is communicated effectively to all stakeholders, including training and support as needed.

By developing a comprehensive CapEx policy, organizations can ensure that their capital expenditures are managed in a responsible and sustainable manner, aligning investments with strategic goals and maintaining robust financial health.

Not sure how Nutrient Workflow can help you conquer the CapEx approval process?

Here’s one example: You can use one of our CapEx approval templates(opens in a new tab) to get a headstart on automating your process.

Your business could turn to a ready-built CapEx management software solution. Still, the benefit of Nutrient Workflow’s powerful and versatile workflows is that we’re not just CapEx software – we’re that and so much more. (Check out our solutions page if you don’t believe us.)

We have a variety of resources to help you on your journey to an automated workflow.

- Workflow Tools and eBooks

- Workflow Ideas Weekly eMail Newsletter(opens in a new tab)

- Recorded Demonstration of our Workflow Automation Software

- Request a Live Demonstration

FAQ

CapEx approval is the process of obtaining authorization for capital expenditures, which are investments in long-term assets.

Automation streamlines CapEx approval by reducing errors, accelerating approval times, and ensuring consistency across teams.

A CapEx policy should include submission guidelines, approval processes, funding requirements, and evaluation criteria.

Cost-benefit analysis helps determine if the proposed investment's benefits outweigh the costs, aiding in better decision-making.

Yes, Nutrient Workflow integrates with finance, ERP, and other systems for streamlined data sharing and reporting.