CapEx automation walkthrough

Table of contents

Consider how your Capital Expenditure or Authorization for Expense request process works. Is it streamlined? Is it predictable? Nutrient Workflow’s ability to automate the manual tasks involved in your CapEx/AFE process makes both possible. Let’s walk through how CapEx automation works.

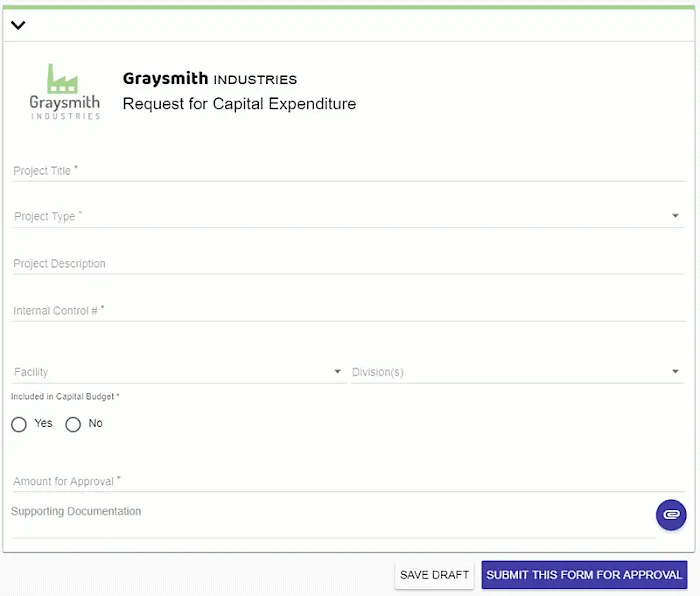

Every capital expenditure request process begins with a form. In our example for the company Graysmith, here’s what their form looks like.

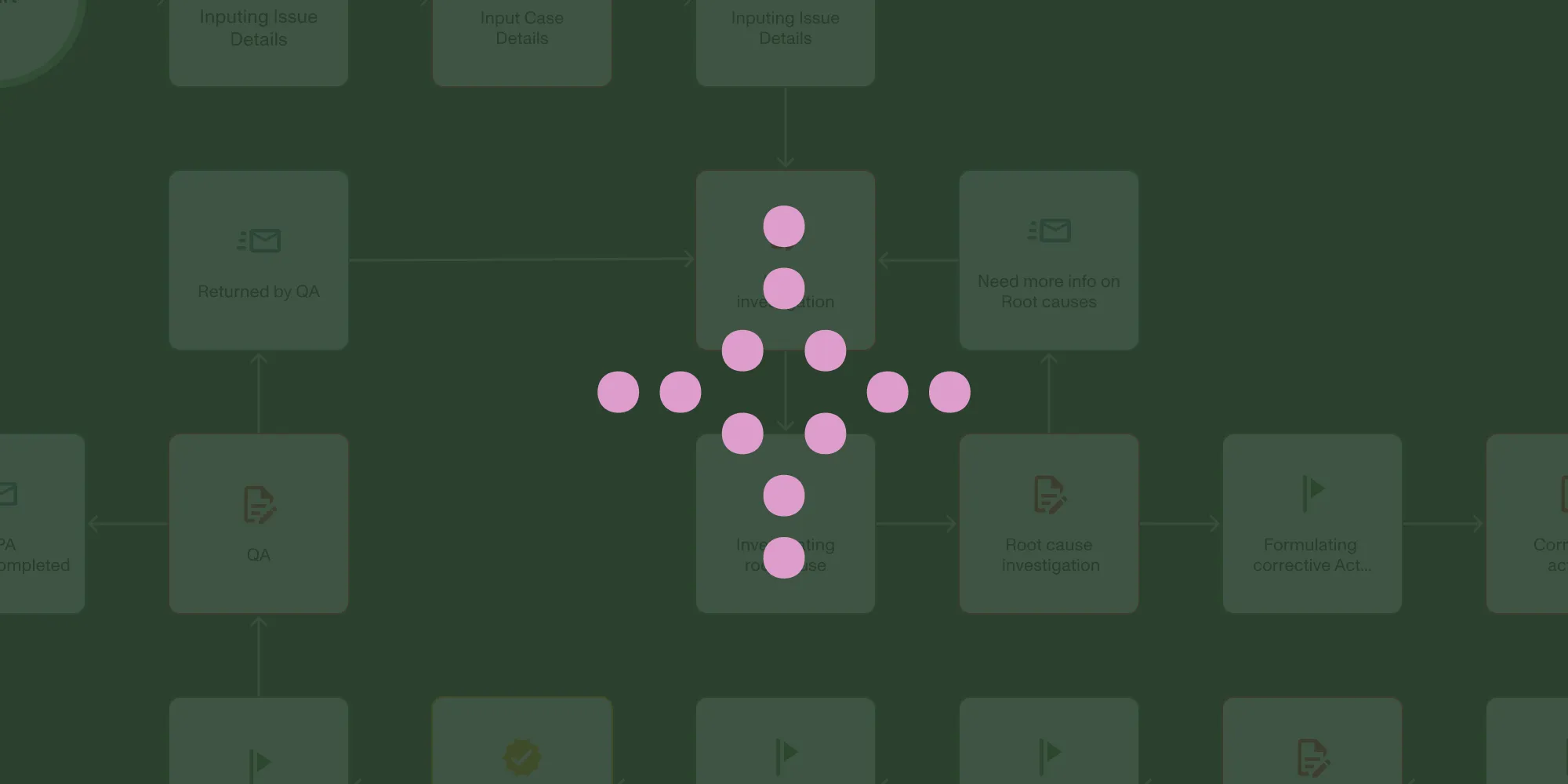

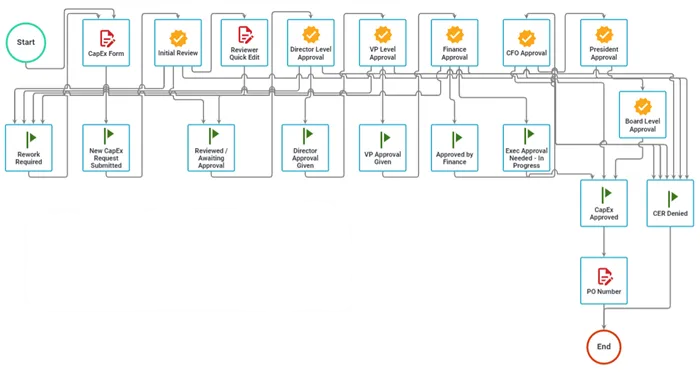

Once the form is submitted, it’s routed based on Graysmith’s custom-built workflow. Here’s what Graystone’s CapEx automation routing looks like.

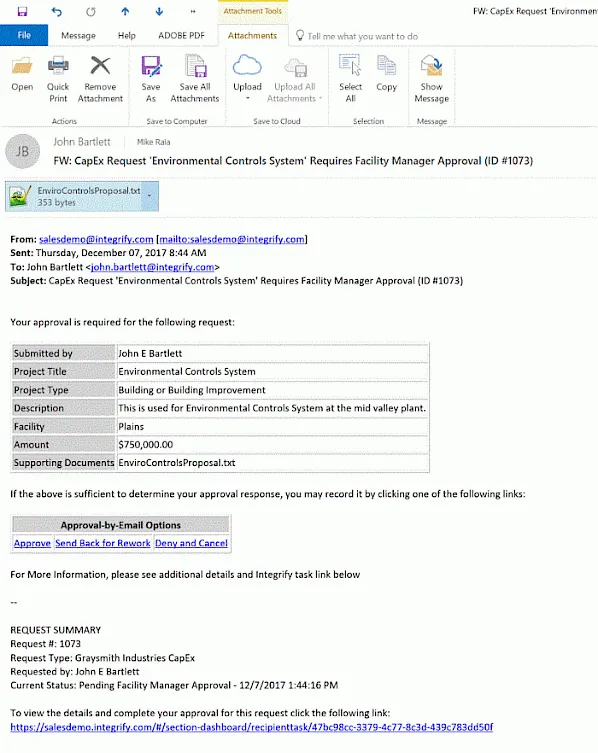

In Graysmith’s process, the first approver is the Facilities Manager. He’ll receive a notification in the system as well as via email. The contains important information about the request including any supporting documentation.

What is CapEx and its importance in business?

CapEx, or Capital Expenditure, refers to the funds used by a company to acquire, upgrade, and maintain physical assets such as property, equipment, and technology. These expenditures are typically long-term investments that are expected to generate benefits for the organization over time. Effective CapEx management is crucial for businesses as it enables them to make informed decisions about investments, manage cash flow, and optimize resource allocation. By carefully planning and managing CapEx, companies can ensure that they are investing in assets that will drive growth and profitability in the long run.

Brief overview of the CapEx approval process

The CapEx approval process typically involves several stages, each designed to ensure that capital expenditure requests are thoroughly evaluated and approved based on their merit. Here’s a brief overview of the process:

- Request submission — Employees or departments submit capital expenditure requests to management or a governing body. This initial step involves detailing the business need, estimated cost, and expected benefits of the proposed expenditure.

- Review and evaluation — The request is reviewed and evaluated based on factors such as business need, cost, and potential return on investment. This stage often involves multiple stakeholders who assess the feasibility and strategic alignment of the request.

- Approval — The request is approved or rejected by authorized personnel. Depending on the amount and nature of the expenditure, this could involve several layers of approval, from department heads to senior executives.

- Implementation — Once approved, the project is implemented, and the expenditure is made. This stage involves procuring the necessary assets and ensuring that the project is executed as planned.

- Monitoring and reporting — The project’s progress and expenditure are tracked and reported to ensure that it is completed on time and within budget. Regular monitoring helps in identifying any deviations from the plan and taking corrective actions as needed.

By following these stages, organizations can ensure a structured and efficient CapEx approval process that supports their strategic goals and financial health.

What is CapEx automation?

CapEx automation refers to the use of advanced software and technology to streamline and automate the capital expenditure (CapEx) approval process. This process encompasses the submission, review, and approval of requests for capital expenditures, such as equipment purchases, property upgrades, or software investments. By leveraging automation, companies can significantly reduce manual errors, enhance efficiency, and improve the overall management of their capital expenditures. With CapEx automation, the approval process becomes more predictable and transparent, ensuring that all requests are handled promptly and accurately.

Watch our full CapEx automation demo video

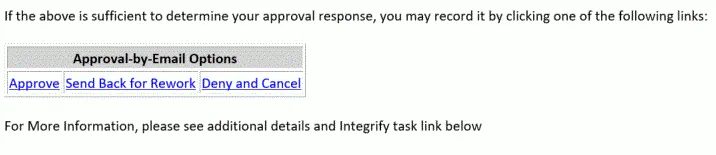

The Manager can approve or reject the request right from the email by clicking a link a the bottom. He can even send it back to the requester for re-work with a click.

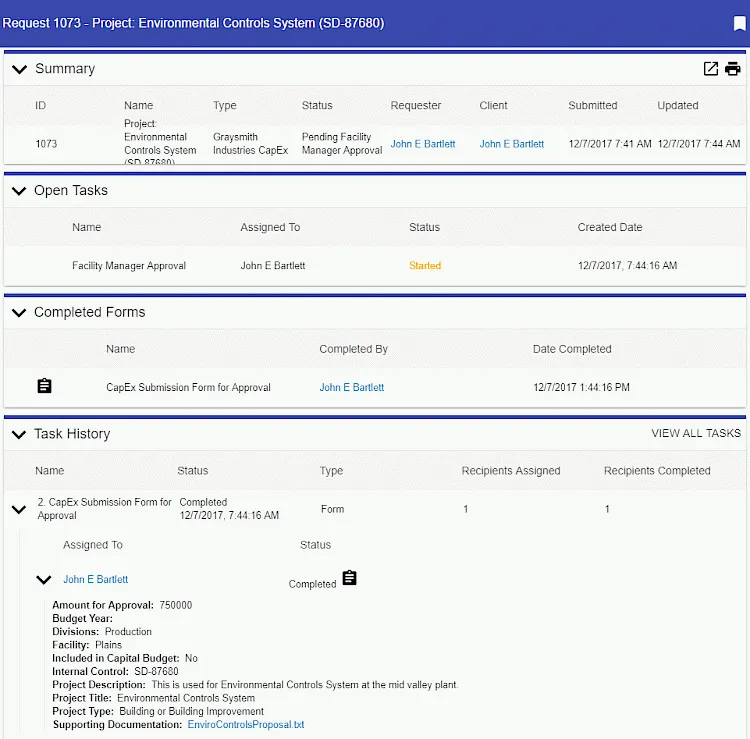

As the request progresses, all the details about what was submitted, what actions were taken, and what comments were made are captured. To ensure transparency, the system stores all questions and answers alongside CapEx requests, so all stakeholders can see the same question that has been asked at different levels of the approval process.

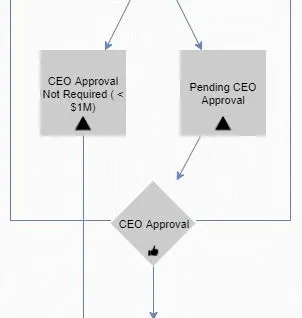

The CapEx request will continue through the review and approval process until it comes to a decision point based on the amount being requested. If it’s over $1M it requires sign-off from the CEO. As you may recall, this request is for $750k, so it can continue on.

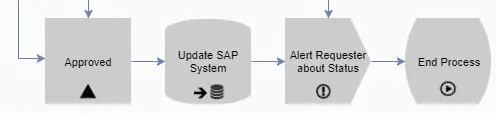

Once the request gets all the way through the approval process the requester is alerted that it’s been approved and the finance system of record (in this case SAP) is updated with the information. Finally, the requester is alerted that the expense has been approved.

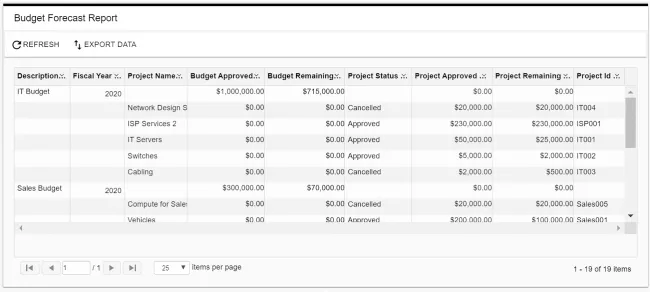

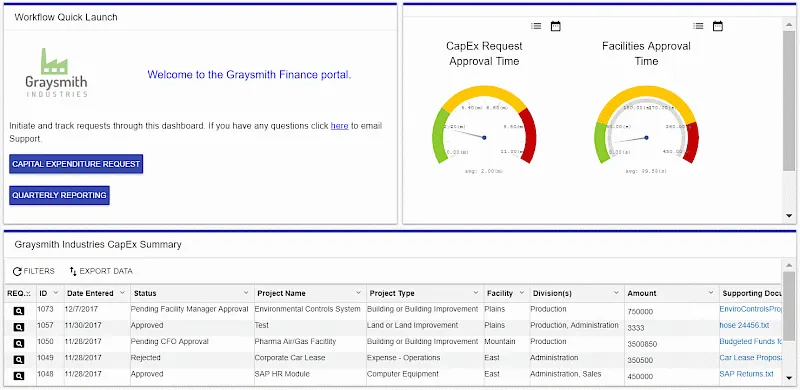

All requests have been aggregated and can be reported on through reporting dashboards. Graysmith publishes performance reports for managers to see right in their self-service CapEx request dashboard.

Users with access can also see budgeting/forecasting information in real-time as new CapEx requests are submitted and reviewed.

As you can see, automating CapEx with Nutrient Workflow:

- Streamlines the entire process

- Ensures predictability and

- Captures all activity for reporting/auditing.

Benefits of automation

The benefits of automating the CapEx approval process are numerous and impactful. Here are some key advantages:

- Improved efficiency — Automation reduces the time and effort required to manage CapEx requests, allowing staff to focus on higher-value tasks instead of repetitive tasks.

- Increased accuracy — Automated processes minimize the risk of manual errors, ensuring that requests are accurate and complete, which is crucial for effective decision-making.

- Enhanced visibility — CapEx automation provides real-time visibility into the approval process, enabling managers to track the status of requests and intervene if needed, ensuring due dates are met.

- Cost savings — Automation can help reduce administrative costs and improve the overall management of capital expenditures, leading to significant cost savings.

- Better decision making — CapEx automation offers a clear and comprehensive view of the investment process, enabling informed decisions that positively impact the company’s cash flow and financial health.

CapEx management software

CapEx management software is designed to automate and streamline the CapEx approval process. This software typically includes several key features:

- Automated workflows — Customizable workflows that route requests to the appropriate approvers and stakeholders, ensuring a smooth and efficient approval process.

- Electronic forms — Digital forms that capture all necessary request information and supporting documentation, reducing the need for paper-based processes.

- Approval tracking — Real-time tracking of request status and approval history, providing transparency and accountability throughout the process.

- Reporting and analytics — Dashboards and reports that offer insights into CapEx activity and trends, helping managers make data-driven decisions.

- Integration — Seamless integration with existing finance, ERP, and other enterprise systems, ensuring that all relevant data is synchronized and up-to-date.

Check out our CapEx Process Accelerator

Find out more about the benefits of automating your CapEx process.

Implementation and rollout

Implementing CapEx automation software requires careful planning and execution. Here are some key considerations for a successful rollout:

- Define business requirements — Identify the specific needs and goals of the organization to ensure the chosen software aligns with these objectives.

- Choose the right software — Select a CapEx management software that meets the organization’s requirements and offers the necessary features and functionalities.

- Configure workflows — Customize workflows to match the organization’s approval process, ensuring that all steps are accurately represented and automated.

- Train users — Provide comprehensive training and support to ensure users are comfortable with the new system and can utilize it effectively.

- Monitor and evaluate — Continuously monitor and evaluate the effectiveness of the CapEx automation software, making adjustments as needed to optimize performance and achieve desired outcomes.

By following these steps, companies can successfully implement CapEx automation software, leading to a more efficient, accurate, and cost-effective approval process.

FAQ

CapEx automation is the use of technology to streamline the capital expenditure approval process, making it more efficient and reducing manual tasks.

By automating workflows, CapEx automation reduces the time spent on manual tasks, allowing staff to focus on more valuable activities.

Key benefits include improved accuracy, real-time tracking, cost savings, and better decision-making capabilities.

Yes, most CapEx automation solutions can integrate with ERP, finance, and other enterprise systems for seamless data management.

CapEx automation can benefit businesses of all sizes, especially those with frequent and complex capital expenditure needs.