What does CapEx mean? Capital expenditure examples and management guide

Table of contents

- What does CapEx mean? Capital Expenditure refers to investments in long-term assets like equipment, buildings, and technology

- CapEx examples include machinery, real estate, software, and vehicles that provide value beyond one year

- Professional CapEx management requires streamlined approval workflows to ensure sound financial decisions

- Nutrient Workflow Automation Platform automates CapEx approval processes, reducing approval time and improving accuracy

Capital Expenditures, commonly abbreviated as "CapEx," represent strategic investments that organizations make in physical and intangible assets to drive long-term growth and operational efficiency. These expenditures are distinguished by two fundamental characteristics:

- Extended value delivery: Assets provide economic benefits beyond the current financial reporting period

- Operational enhancement: Investments expand or improve the company's operational capacity and capabilities

Capital expenditure items appear on cash flow statements and balance sheets, reflecting investments in property, plant, equipment, and other long-term assets that form the foundation of business operations.

Need clarity on CapEx vs. OpEx? Learn the key differences in our comprehensive guide: CapEx vs OpEx

Understanding what CapEx means for business growth

When organizations ask "what does CapEx mean?" they're seeking to understand one of the most critical components of strategic financial planning. Capital Expenditure (CapEx) encompasses the funds organizations deploy to acquire, upgrade, and maintain physical and digital assets including real estate, manufacturing equipment, enterprise software, and technological infrastructure.

These strategic investments serve multiple business objectives:

- Growth enablement: Expanding operational capacity to meet increasing demand

- Competitive advantage: Implementing cutting-edge technology and efficient processes

- Revenue generation: Creating assets that produce long-term income streams

- Operational optimization: Improving efficiency through modernized equipment and systems

Successful CapEx management requires sophisticated approval workflows that evaluate investment potential, assess risk factors, and ensure alignment with strategic objectives. This is where Nutrient Workflow Automation Platform delivers exceptional value, transforming manual approval processes into streamlined, automated workflows that accelerate decision-making while maintaining rigorous oversight.

Strategic categories of capital expenditure

To fully understand what CapEx means in practice, it's essential to recognize the two primary categories that drive organizational investment decisions:

Maintenance CapEx

Investments required to sustain current operational capabilities and prevent asset degradation, ensuring business continuity and regulatory compliance.

Growth CapEx

Strategic investments designed to expand market presence, increase production capacity, or enhance competitive positioning through technological advancement.

Professional CapEx examples across these categories include:

- Technology infrastructure: Enterprise servers, cloud computing systems, cybersecurity platforms

- Manufacturing assets: Production machinery, automated assembly lines, quality control equipment

- Real estate investments: Corporate facilities, warehouses, distribution centers

- Transportation assets: Commercial vehicles, logistics equipment, fleet management systems

- Software and licenses: Enterprise applications, productivity suites, specialized industry tools

- Furniture and fixtures: Office infrastructure, laboratory equipment, retail displays

- Capital leases: Long-term equipment rentals with ownership transfer provisions

Each category requires distinct evaluation criteria and approval workflows, making automated CapEx management systems like Nutrient Workflow Automation Platform invaluable for maintaining consistency and reducing approval cycle times.

CapEx vs. Operating Expenses (OpEx)

Capital expenditures (CapEx) and operating expenses (OpEx) are two distinct types of expenses that businesses incur. The primary difference between them lies in their purpose and duration. Operating expenses are the costs required for the day-to-day functioning of a business. These include expenses such as rent, wages, utility costs, and office supplies. OpEx is typically fully deductible from the company’s taxes in the same year the expenses occur, making them short-term in nature.

In contrast, capital expenditures are long-term investments made to acquire or improve fixed assets like property, plant, and equipment. These expenses are not fully deductible in the year they are incurred. Instead, they are capitalized and depreciated over the useful life of the asset. For example, purchasing new machinery or upgrading existing assets to enhance production capacity falls under CapEx. By investing in CapEx, companies aim to increase their operational scope and future performance.

Calculating Capital Expenditure

Calculating capital expenditure involves understanding the changes in a company’s property, plant, and equipment (PP&E) and accounting for the current depreciation expense. The formula for calculating CapEx is:

CapEx = ΔPP&E + Current Depreciation

Where:

- ΔPP&E represents the change in property, plant, and equipment.

- Current Depreciation is the depreciation expense for the current period.

For instance, if a company’s PP&E increased by $500,000 over the year and the current depreciation expense is $100,000, the total capital expenditure would be $600,000. This calculation helps in understanding the total investment made in acquiring or upgrading long-term assets.

CapEx on the Cash Flow Statement

Capital expenditures can be found on a company’s cash flow statement under the “Investing Activities” section. This section includes all the investments made by the company in long-term assets, such as PP&E, as well as any proceeds from the sale of these assets. The cash flow statement provides a clear picture of a company’s investing activities, including its capital expenditures, and helps investors and analysts understand the company’s investment strategy and its impact on cash flow.

Impact of CapEx on Financial Statements

Capital expenditures have a significant impact on a company’s financial statements, including the income statement, balance sheet, and cash flow statement. On the income statement, CapEx is recorded as a depreciation expense, which represents the decrease in the value of the asset over its useful life. On the balance sheet, CapEx is recorded as an asset, and its value is depreciated over time. The cash flow statement, as mentioned earlier, shows the cash outflows related to CapEx. Understanding the impact of CapEx on financial statements is crucial for investors and analysts to evaluate a company’s financial performance and make informed decisions.

Capital Expenditure and Depreciation Expense

When a company makes a capital expenditure, it is recorded as an asset on the balance sheet. This asset is then depreciated over its useful life, which is the period during which the asset is expected to generate revenue for the company. Depreciation expense represents the decrease in the value of the asset over time.

For example, if a company purchases a piece of equipment for $10,000 with a useful life of 5 years, the annual depreciation expense would be $2,000. This means that each year, $2,000 is recorded as a depreciation expense on the income statement, reducing the asset’s value on the balance sheet. This process continues until the asset is fully depreciated.

Challenges with capital expenditure management

Organizations face significant operational and financial challenges when managing capital expenditures manually. These complexities underscore why understanding what CapEx means extends beyond simple definitions to encompass sophisticated management strategies.

Key CapEx management challenges include:

- Cash flow complexity: Substantial upfront investments can strain working capital, particularly when revenue realization timelines are uncertain

- Risk assessment difficulties: Evaluating new technologies and untested assets requires comprehensive analysis frameworks that many organizations lack

- Approval bottlenecks: Manual review processes create delays, impacting time-sensitive investment opportunities

- Compliance requirements: Ensuring adherence to financial controls and regulatory standards throughout the approval process

- Data accuracy issues: Incomplete or inconsistent information leads to suboptimal investment decisions

- Cross-departmental coordination: Aligning stakeholders across finance, operations, and strategic planning functions

The solution: Nutrient Workflow automation

These challenges demonstrate why leading organizations implement Nutrient Workflow Automation Platform to transform their CapEx management processes. By automating approval workflows, Nutrient Workflow eliminates bottlenecks, ensures consistent evaluation criteria, and provides real-time visibility into investment pipelines.

Professional CapEx budgeting with workflow automation

Understanding what CapEx means in practice requires implementing systematic approaches to budgeting and approval management. Modern organizations leverage workflow automation platforms to optimize these critical processes.

Essential CapEx budgeting strategies:

- Pre-investment planning: Establish comprehensive budgets with defined ROI metrics before initiating expenditure processes

- Long-term strategic alignment: Evaluate investments against multi-year business objectives and market positioning goals

- Automated workflow systems: Deploy Nutrient Workflow Automation Platform to standardize evaluation criteria and accelerate approval cycles

- Data-driven decision making: Capture comprehensive financial, operational, and strategic data for informed investment analysis

- Optimized detail levels: Balance thoroughness with efficiency through configurable workflow templates and approval hierarchies

- Cross-functional collaboration: Enable seamless coordination between finance, operations, and strategic planning teams

Transform your CapEx management with Nutrient Workflow

Organizations implementing these strategies through Nutrient Workflow Automation Platform experience significant improvements in approval speed, decision quality, and strategic alignment. The platform's configurable workflows ensure consistent evaluation while maintaining the flexibility to adapt to unique organizational requirements.

Why CapEx automation is essential for modern organizations

Understanding what CapEx means in today's business environment requires recognizing that manual approval processes are no longer sufficient for managing complex capital expenditure decisions. Organizations face increasing pressure to make faster, more accurate investment decisions while maintaining rigorous financial controls.

Critical benefits of CapEx automation with Nutrient Workflow Automation Platform:

Accelerated approvals

Reduce approval cycles from weeks to days through automated routing, parallel reviews, and real-time notifications

Enhanced accuracy

Eliminate errors through standardized forms, automatic calculations, and built-in validation rules

Complete visibility

Track investment requests in real-time with detailed audit trails and comprehensive reporting dashboards

Risk mitigation

Ensure consistent evaluation criteria and regulatory compliance through configurable approval hierarchies

Organizations implementing Nutrient Workflow Automation Platform for CapEx management report significantly faster approval times and substantial improvements in decision quality, transforming capital expenditure processes from operational burdens into strategic advantages.

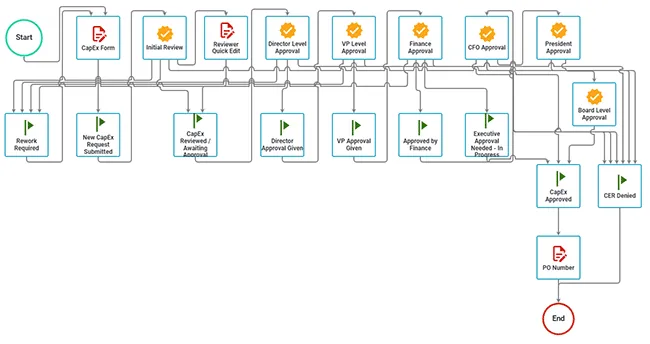

Example of a CapEx Process

In larger enterprises, requesting and approving capital expenditures can be complex and involve many different individuals and departments. Automating the CapEx approval process can decrease acquisition time, improve accuracy and provide complete audit reporting. Here's an example of an automated CapEx form that collects all the critical information for consideration by approvers:

(Click for Larger)

Once the form is completed, it can be routed through the organization for review, approval, rework, or disapproval.

Transform your CapEx management with Nutrient Workflow

Now that you understand what CapEx means and have seen practical examples, it's time to revolutionize your capital expenditure processes. Nutrient Workflow Automation Platform provides the comprehensive automation solution your organization needs to streamline approvals, reduce costs, and accelerate decision-making.

Ready to eliminate CapEx approval bottlenecks? Experience the power of automated workflow management with Nutrient Workflow Automation Platform's comprehensive capital expenditure solutions.

Start your transformation today:

- Explore workflow solutions tailored to your industry

- Contact our workflow specialists for custom implementation guidance

- Learn more about workflow automation with our comprehensive guides

Join thousands of organizations worldwide who have transformed their CapEx management processes with Nutrient Workflow Automation Platform. Experience faster approvals, improved accuracy, and enhanced visibility across all your capital expenditure decisions.

FAQ

CapEx, or Capital Expenditure, means investments in long-term assets that provide value beyond one year. This includes property, equipment, technology, and infrastructure that enhance operational capacity and drive business growth. Understanding what CapEx means is essential for strategic financial planning and investment decision-making.

CapEx involves long-term investments in fixed assets, while OpEx covers short-term costs for daily operations, like rent and salaries.

CapEx is crucial for growth, allowing businesses to invest in new assets that can enhance productivity and drive future revenue.

CapEx is calculated by adding the change in property, plant, and equipment (PP&E) to the current depreciation expense.

Nutrient Workflow Automation Platform transforms CapEx management by automating approval processes, reducing approval time significantly, and providing real-time visibility into investment pipelines. The platform ensures consistent evaluation criteria while maintaining regulatory compliance and comprehensive audit trails.