Capital Budgeting Process | Automate Budget Approval Workflow

Table of contents

Upgrade your budgeting process to meet the demands of the modern era through intelligent automation, seamless integration, and a completely traceable process.

What is Capital Budgeting?

Capital budgeting is the process of analyzing whether significant monetary expenditures make sense for a business. The capital budgeting process is a procedure that most businesses use when they want to properly evaluate an investment or expenditure with a higher dollar amount. The process can be used to determine whether to invest in specific funds, add new funds, or the process of replacing, removing, or purchasing new fixed assets. Capital expenditures typically involve decisions involving buildings, land, equipment, or research and development.

Capital budgeting is used when making these decisions to maximize the company's future profit. Capital budgeting decisions usually involve analysis of the project’s total cost, its estimated return on investment, and the residual or terminal value afterward, to name a few. During the process, you will project the investment's future accounting profit, its effect on cash flow, and the cash flow value after considering the money's time value during set periods. You will also use this process to determine how long it will take to repay the initial investment and how risky it may be for the company.

When Is Capital Budgeting Used?

While expense budgeting will be used for more immediate needs and smaller investments, capital budgeting decisions will involve more significant projects that can have a long-term effect on a company. In the end, the expectation is that the project will not only pay back the original cost of the investment but also generate a profit. Projects and investments involving budgeting are often on a company's wish list. This means they are items to consider over time as the company grows.

Common Steps in the Capital Budgeting Process

Capital budgeting procedures can be more or less involved depending on the project or investment being reviewed but will always involve a few basic steps that guide the process.

1. Identification and Generation of the Project

Before beginning the budgeting process, you must identify the project or investment you would like to have reviewed and generate a proposal or capital expenditure request. The proposal will typically include the parameters of the project or investment and why you feel it would benefit the company's future. While the end benefit normally increases profit, the proposal should include information about how that profit is expected to be achieved. Will the project increase production and reduce costs? Will it result in more sales?

2. Determine the Total Cost of the Investment and Return

The total investment will be either the cost of the acquired asset or the costs required to fund the project. You will then need to calculate the net cash flow you can expect to return on the investment. Usually, this will be done by creating a projected income statement for the project or investment.

3. Determine the Residual or Terminal Value

The residual value will need to be determined for projects or finite assets. In the case of a piece of equipment, the residual value will be equal to the net proceeds that you will be entitled to when it comes time to dispose of the asset. If an asset can continue indefinitely into the future, you will want to calculate the terminal value. An example of this type of project would be adding a new business division.

To calculate a terminal value, you will be working off the assumption that the final year included in the projection will continue in the future with no finite time limit. You take the last cash flow value and then divide it by the discount rate, which is the interest rate used to determine the present value of future cash flows. This value will be used for projections past the original project scope if the investment is expected to continue indefinitely.

4. Calculate Annual Cash Flow

4. Calculate Annual Cash Flow

You will calculate the annual cash flow if you arrange the values from the first three steps into a timeline. When cash is flowing out, the value will be negative. When cash is flowing in, you will have a positive value. You can then add each period's cash flows to create the annual cash flow.

5. Figure the Net Present Value of Cash Flows

Next, you must calculate the NPV of all of your cash values. This amount will be the total present value of each year's cash flow. NPV can be determined with the following formula. Present Value of Cash Flow = Cash Flow / (1 + Discount Rate) Year. When the NPV is positive, the value will be the value in excess of the original investment amount. These are projects that are worth looking further into.

6. Run Your Analysis

While a positive NPV is a good sign, it is not usually enough to get approval for expenditure. Since the process of projections can be complicated, it is always important to analyze the what-ifs that may alter the project's anticipated outcome. Some what-ifs to consider include:

- What if the total cost of the project comes in higher?

- What if the residual value has been overstated?

- What if the operating cash flows are less than anticipated?

After determining answers to the possible what-ifs, you can decide if the project or investment would still be sound and likely profitable. This is typically the last step in the budget approval process before deciding.

Rules to Follow During the Capital Budgeting Process

To be successful, it is essential to follow some basic rules. The first of these is to have accurately projected cash flows. This part of the process can be more difficult as cash flow involves more and can affect more parts of a business, such as accounts receivable and payable, inventory, revenues, and expenses.

Try to be as detailed as possible when projecting cash flows. Improper evaluation of this budgeting process component can lead to an understated cash flow, resulting in a smaller return or even a loss on a project or investment.

Another important rule with capital budgeting is not overestimating the terminal or residual value. If this occurs, you may find that the NPV is not as high as it should be, or in some cases, overestimation can lead to a negative NPV.

Finally, since the process can have a high risk of error if not done correctly, it is critical to have someone with the proper expertise to calculate and process a capital expenditure request. Someone with sufficient expertise will also be objective and look at the investment in terms of monetary figures instead of emotion. Capital budgeting often requires input from accountants, financial advisors, the project planner, and executive-level members of the company.

During the capital expenditure process, it is essential to have a set of policies, procedures, and rules that are followed to ensure that all the information is properly calculated, the investment complies with your borrowing base, and the final decision is made on an accurate projection of cash flow and returns. This will allow for decisions that are in the best interest of the company's future.

For some businesses finding the time and people with the proper expertise in capital budgeting can be challenging. If this is true of your company, the solution is automating the process. With workflow automation software, the process can be as simple as entering the appropriate data and letting the software perform the calculations for you. By simplifying the process, you will reduce the amount of human error and be able to work from a more accurate projection. This can make the difference between your company investing in something profitable or taking an unexpected loss.

Automating the Process

Nutrient Workflow's workflow automation platform can help you automate any budgeting process by providing tools to design your custom process for receiving requests, providing approvals, sharing documents, collaborating, and integrating with your accounting systems.

With Nutrient Workflow, you can sequence all the tasks to be performed as part of the process and assign them to individuals, groups, or dynamically. As tasks are completed sequentially or in parallel, all the activity is captured, including time, date, individual, actions taken, forms submitted, and documents provided. This information can be reported historically or in real time.

How Does Nutrient Workflow Automate CapEx/AFE?

Nutrient Workflow's platform allows finance teams to scope, design, and implement an automated process based on their unique needs. Since not every process for every organization has the exact requirements, Nutrient Workflow is flexible and scalable for any use case. We've worked with hundreds of different finance teams to help them plan and build their automated CapEx/AFE budget process so you won't be alone in your journey.

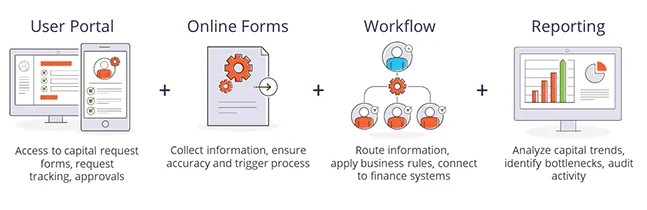

Nutrient Workflow's platform provides the necessary components to automate any CapEx/finance process:

Our CapEx Process Accelerator

Depending on your timeline and requirements, we offer a rapid implementation package called our "CapEx Process Accelerator." See how it works below.

Interested in the Accelerator? Learn more here.

The Benefits of Automation

- Improve the efficiency of business processes and operations.

- Reduce errors and re-work.

- Reduce the risk of non-standard process activity.

- Improve compliance with audit trails.

- Increase output and increase productivity.

Interested in Automating Your Budgeting Process?

We have various resources to help you navigate an automated workflow.

- Workflow Tools and eBooks

- Workflow Ideas Weekly eMail Newsletter(opens in a new tab)

- Recorded Demonstration of our Workflow Automation Software

- Request a Live Demonstration(opens in a new tab)

Sources

https://www.investopedia.com/terms/c/capitalbudgeting.asp(opens in a new tab)