See how Village for Vets cut delays, eliminated audit risks, and reclaimed 10+ hours per week using Nutrient’s low-code automation.

Read moreSee how Village for Vets cut delays, eliminated audit risks, and reclaimed 10+ hours per week using Nutrient’s low-code automation.

Read more

See how Village for Vets cut delays, eliminated audit risks, and reclaimed 10+ hours per week using Nutrient’s low-code automation.

Read more

See how Village for Vets cut delays, eliminated audit risks, and reclaimed 10+ hours per week using Nutrient’s low-code automation.

Read more

See how Village for Vets cut delays, eliminated audit risks, and reclaimed 10+ hours per week using Nutrient’s low-code automation.

Read more

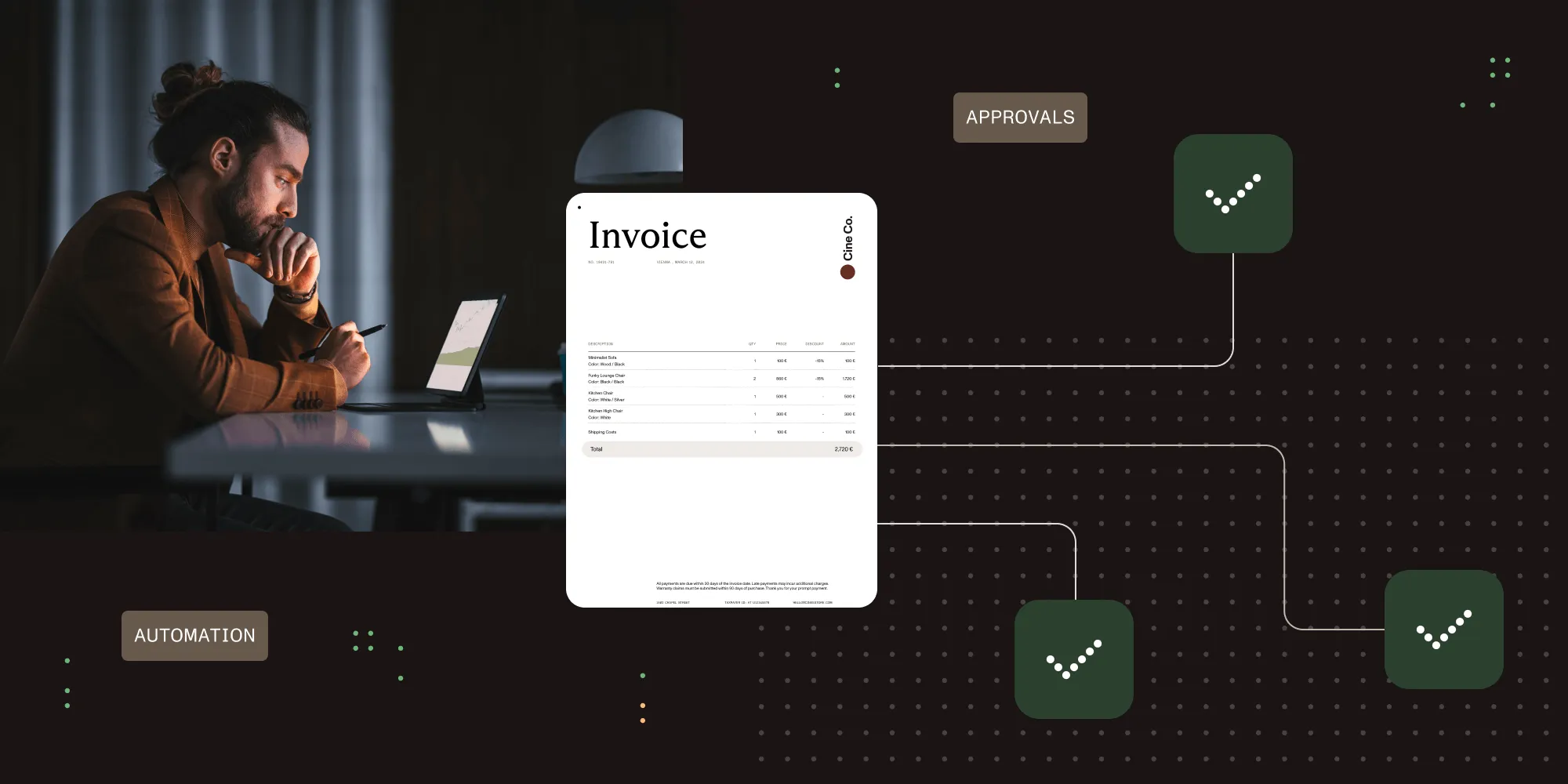

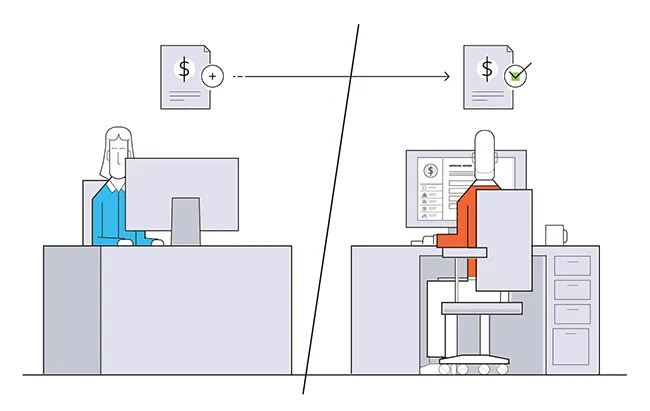

Discover how finance workflow automation eliminates bottlenecks, enhances fraud protection, and creates audit-ready financial processes.

Read more

Discover how finance workflow automation eliminates bottlenecks, enhances fraud protection, and creates audit-ready financial processes.

Read more

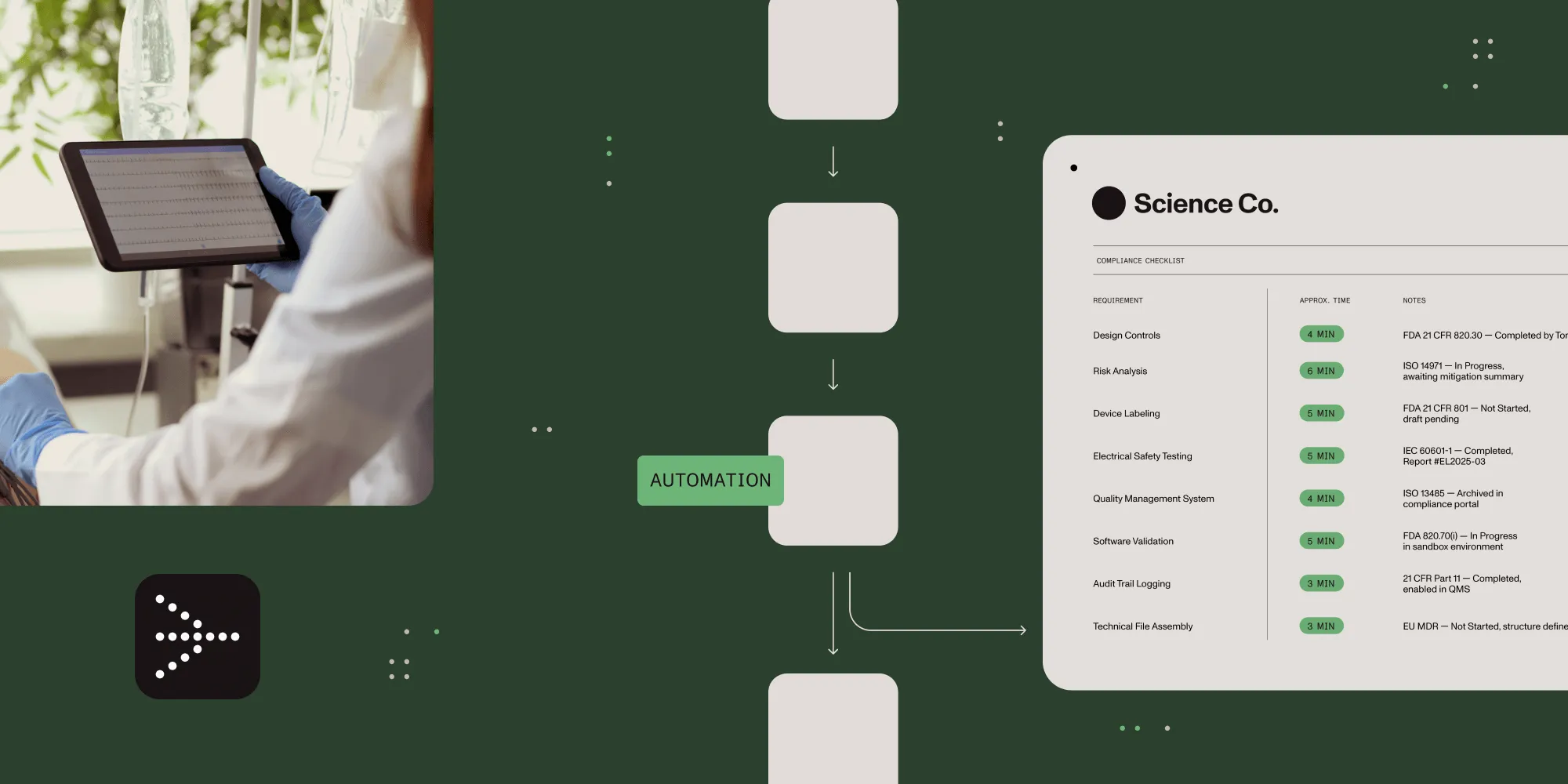

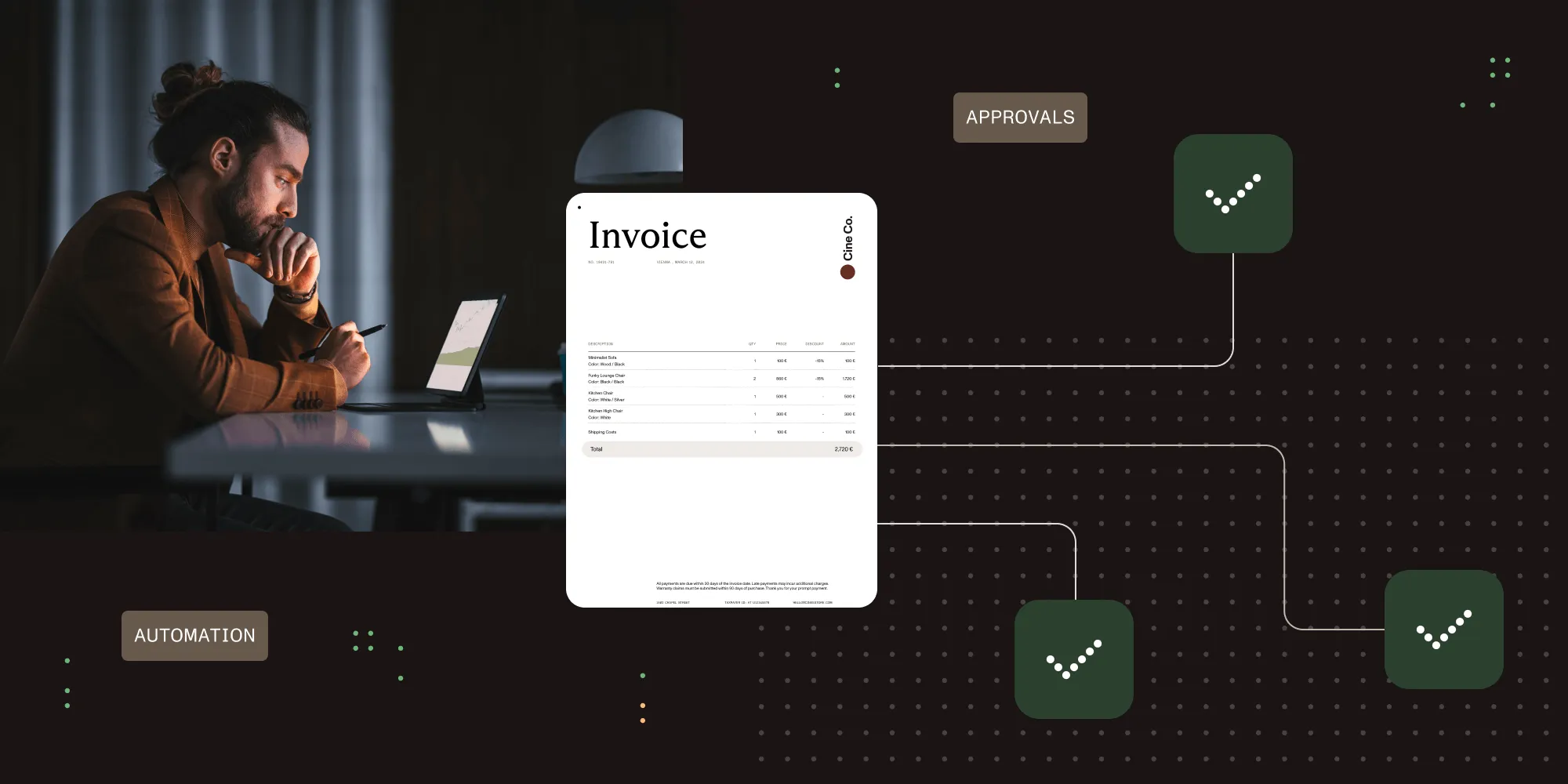

Discover how Nutrient Workflow Automation transforms pharmaceutical protocol management, enhancing compliance and accelerating document approvals.

Read more

Michael Del Regno

Discover the real-world challenges and growth of a junior developer transitioning from college to a professional career. Insights on learning React, teamwork, and overcoming obstacles in software development.

Read more

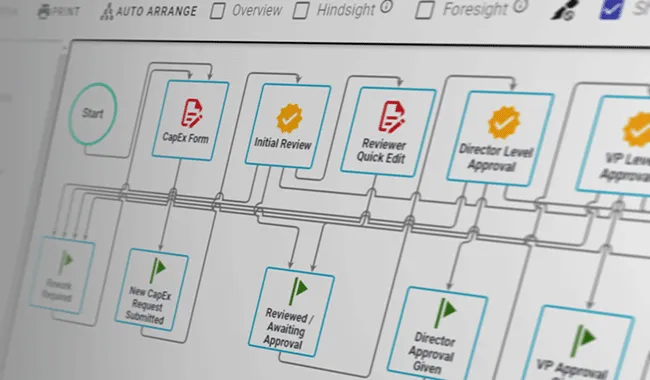

Learn how automated CapEx approvals can transform healthcare operations, cut approval times, and improve compliance.

Read more

Babi Brasileiro

Discover how Nutrient crafted a unique audio brand that brings our identity to life through sound. Learn how music, sound design, and emotional storytelling create a cohesive, immersive brand experience across every touchpoint.

Read more

Babi Brasileiro

Discover how Nutrient crafted a unique audio brand that brings our identity to life through sound. Learn how music, sound design, and emotional storytelling create a cohesive, immersive brand experience across every touchpoint.

Read more

Learn how to automate document creation with Office templating using Nutrient. Explore API, SDK, and no-code workflow options to generate DOCX and PDF files effortlessly.

Read more

The Future of Workflow Automation Summit was sponsored by Nutrient to support automation technology for documents and workflows.

Read more

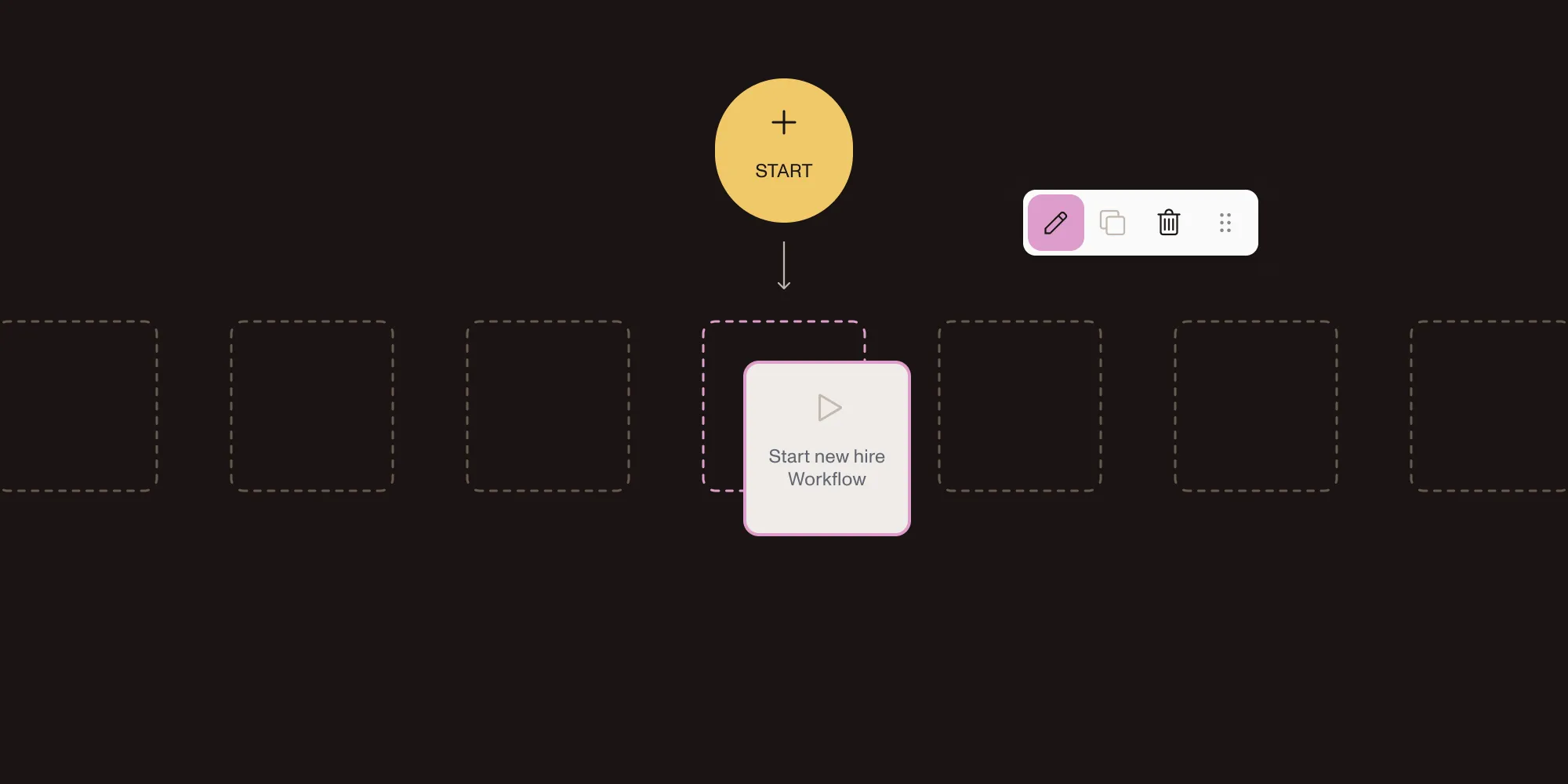

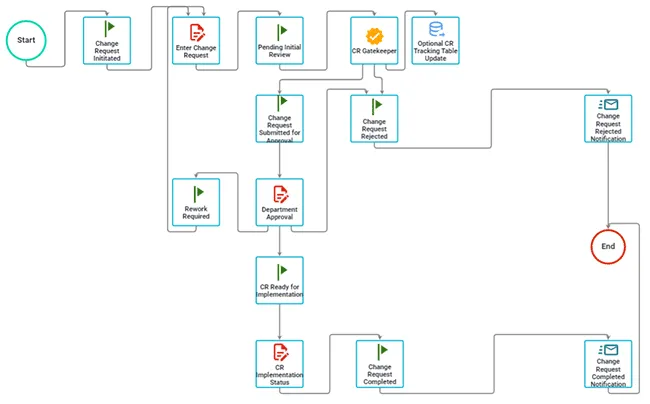

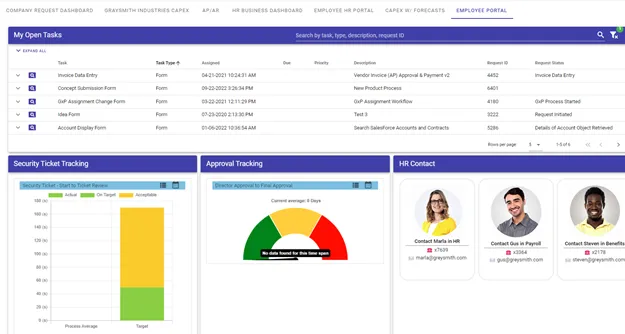

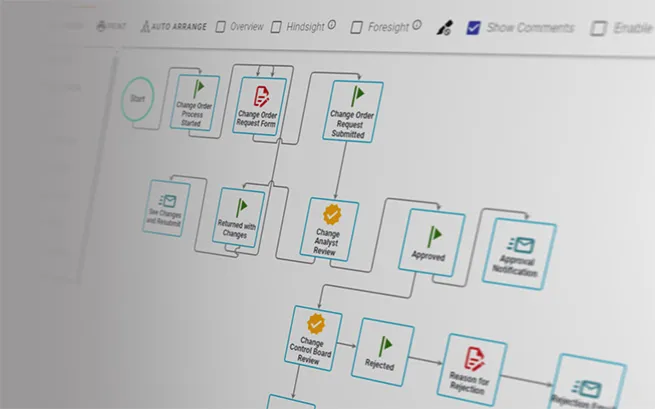

How we use Workflow Automation to rapidly create functional workflows for potential customers.

Read more

Clavin Fernandes

Discover how to automate customer registration and service requests in Dynamics 365 using Workflow Automation for improved efficiency.

Read more

Clavin Fernandes

Discover how to automate customer registration and service requests in Dynamics 365 using Workflow Automation for improved efficiency.

Read more

Penny Liu

Michael Del Regno

Babi Brasileiro

Jonathan D. Rhyne

Jonathan D. Rhyne

Toni Buffa

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Deanna deBara

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Clavin Fernandes

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Deanna deBara

Jonathan D. Rhyne

Toni Buffa

Jonathan D. Rhyne

Deanna deBara

Toni Buffa

Jonathan D. Rhyne

Deanna deBara

Mike Raia

Toni Buffa

Toni Buffa

Toni Buffa

Meredith Summers

Toni Buffa

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Deanna deBara

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Deanna deBara

Joanne Wortman

Toni Buffa

Toni Buffa

Toni Buffa

Deanna deBara

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Toni Buffa

Mike Raia

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Mike Raia

Toni Buffa

Toni Buffa

Toni Buffa

Deanna deBara

Toni Buffa

Mike Raia

Mike Raia

Deanna deBara

Toni Buffa

Deanna deBara

Toni Buffa

Deanna deBara

Deanna deBara

Toni Buffa

Jonathan D. Rhyne

Toni Buffa

Toni Buffa

Deanna deBara

Toni Buffa

Deanna deBara

Mike Raia

Deanna deBara

Deanna deBara

Deanna deBara

Deanna deBara

Deanna deBara

Jonathan D. Rhyne

Deanna deBara

Jonathan D. Rhyne

Mike Raia

Mike Raia

Katy Reid

Deanna deBara

Jonathan D. Rhyne

Deanna deBara

Katy Reid

Deanna deBara

Katy Reid

Katy Reid

Mike Raia

Deanna deBara

Mike Raia

Deanna deBara

Maria Thomas

Mike Raia

Mike Raia

Deanna deBara

Mike Raia

Mike Raia

Mike Raia

Mike Raia

Mike Raia

Joanne Wortman

Cindy Cook DeRuyter

Mike Raia

Jonathan D. Rhyne

Mike Raia

Mike Raia

Mike Raia

Mike Raia

Mike Raia

Chris Campbell

Mike Raia

Mike Raia

Cindy Cook DeRuyter

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Meredith Summers

Joanne Wortman

Mike Raia

Joanne Wortman

Joanne Wortman

Mike Raia

Cindy Cook DeRuyter

Joanne Wortman

Joanne Wortman

Joanne Wortman

Cindy Cook DeRuyter

Mike Raia

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Jonathan D. Rhyne

Integrify

Integrify

Integrify

Integrify

Jonathan D. Rhyne

¯\_(ツ)_/¯

Nothing left to show