Finance Teams Are Spending Too Much Time Processing Transactions

Table of contents

According to PwC(opens in a new tab), today's finance leaders are improving business results by investing in commercial insight, spending less time on transactional work, and running at lower costs.

They're also keeping automation high on their list of priorities as part of the push to digital transformation.

Finance team leaders envision a Finance team that contributes strategic financial information and recommendations that help the business operate efficiently while growing exponentially. They don't envision a team of order takers and data entry specialists.

Part of this discussion is about achieving agility in high-performing Finance teams , which often returns focus to automation.

Workflow Automation to the Rescue

The primary method for getting Finance pros out of the data entry (and re-entry business) is through workflow automation. By moving paper forms, spreadsheets, and email requests to an online workflow system, Finance teams can spend more time focused on strategic work and less on transactional busywork. A world-class finance team is able to automate key transactional inputs and spend more time contributing to the business in a strategic way.

How Does It Work?

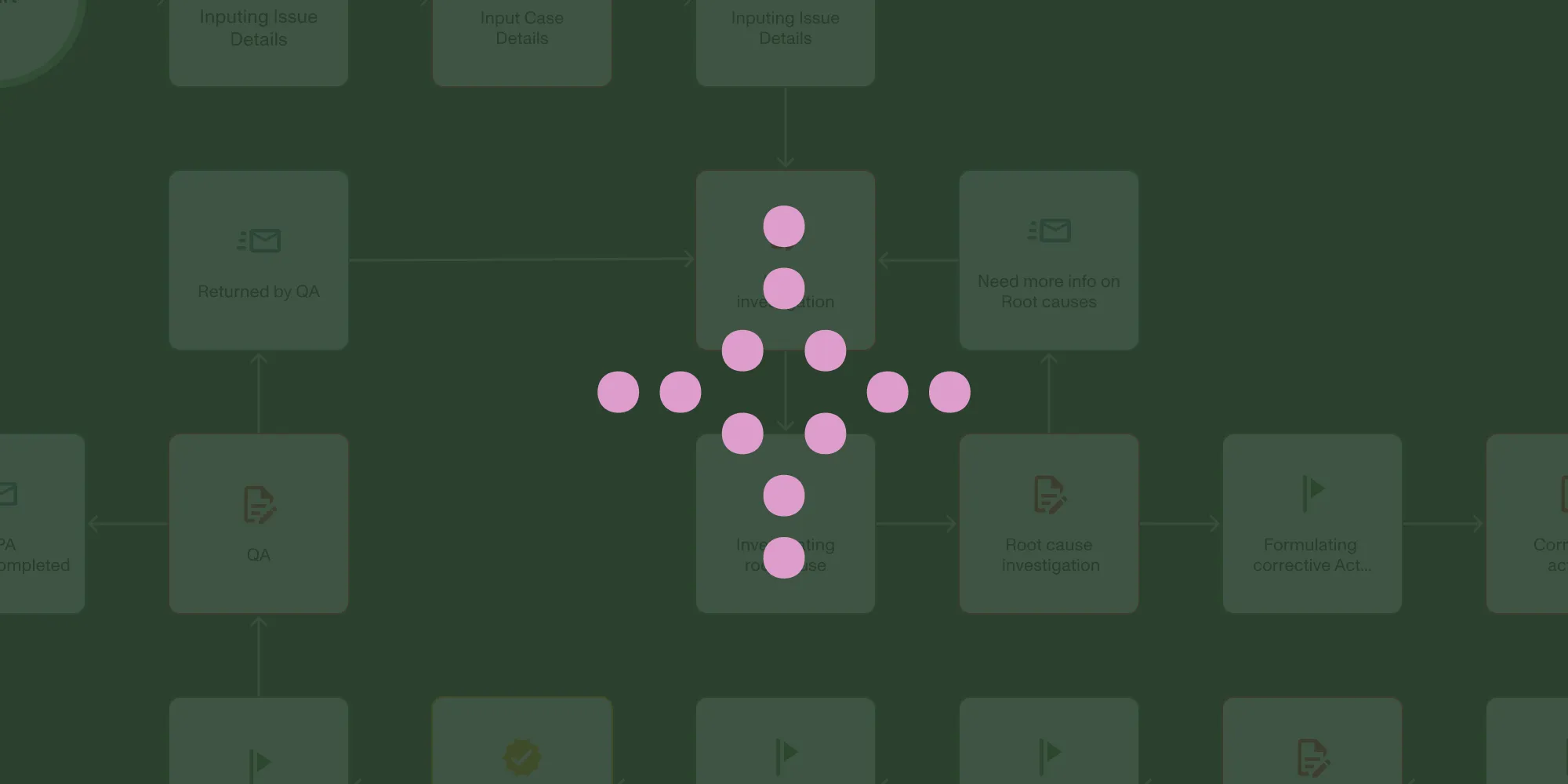

Workflow automation allows finance organizations to build custom, automated processes that mirror or improve upon their existing, manual processes. Users access forms through a central portal and submit requests, report incidents, launch multi-step approval processes, etc. As tasks are completed by the appropriate coworker or manager involved in the process, new tasks may be spawned and information continues to flow through the organization following pre-set rules until the process completes. If more information is needed at any point in the process, process members can easily request it from anyone involved.

Example: Capital Expenditure Requests

By using Workflow Management software to design custom capital expenditure processes, Finance teams can significantly improve the CapEx request approval process and reduce their CapEx approval cycle times by up to 35%. While providing unprecedented transparency into the entire process. By automating CapEx, projects and expenditures stay aligned with the organization's capital financial strategies and objectives. If you're considering automating CapEx specifically, we have a free CapEx planning guide(opens in a new tab) and you can visit our CapEx Process Walkthrough.

Save time and money with a pre-built Finance Process App from our growing library.(opens in a new tab)

Calculate the ROI

To get a better idea of the amount of time that can be gained back, we created a Workflow Automation ROI Calculator. Simply enter basic information like Requests per month and minutes per request and watch how much productivity can be gained.

- How much of our time is spent processing simple internal transactions?

- Are some individuals doing more transactions than others?

- Where are the process bottlenecks?

- If we could completely eliminate routine transaction processing, where would we use that extra time?

- What strategic projects are languishing because we don't have time to devote to them?

Workflow Management Guide for Finance

Also, download our free eBook "Workflow Management Guide for Finance"(opens in a new tab) which provides details on bringing workflow automation to your Finance organization including case studies, workflow examples, project management tips, and more.

Looking for More Workflow Resources?

We've got a growing library of workflow automation resources that are free to download. Just visit our Resources library.